A new decade, new opportunities and challenges. At this time, the world is trying to grapple with how to effectively respond to the COVID-19 outbreak, including the home insurance industry.

Instead of trying to predict what will happen in the decade to come, we thought it would be a more valuable exercise to review the biggest trends in the home insurance realm from the 2010s. In these times full of uncertainty and unprecedented action, it might be a welcome reprieve to look back at the last decade – it doesn’t look too bad now, does it?!

Many of the trends from the past decade, especially around digitalization and uptake of technology will likely accelerate this year and in the years to come, as the pandemic has forced many sectors to future-proof their operations against similar events. Although the future seems more uncertain than ever, many of the developments from the 2010s are bound to keep influencing the home insurance sector in the years ahead.

Let’s have a look back at the 5 main trends that impacted the home insurance industry from 2010-2019.

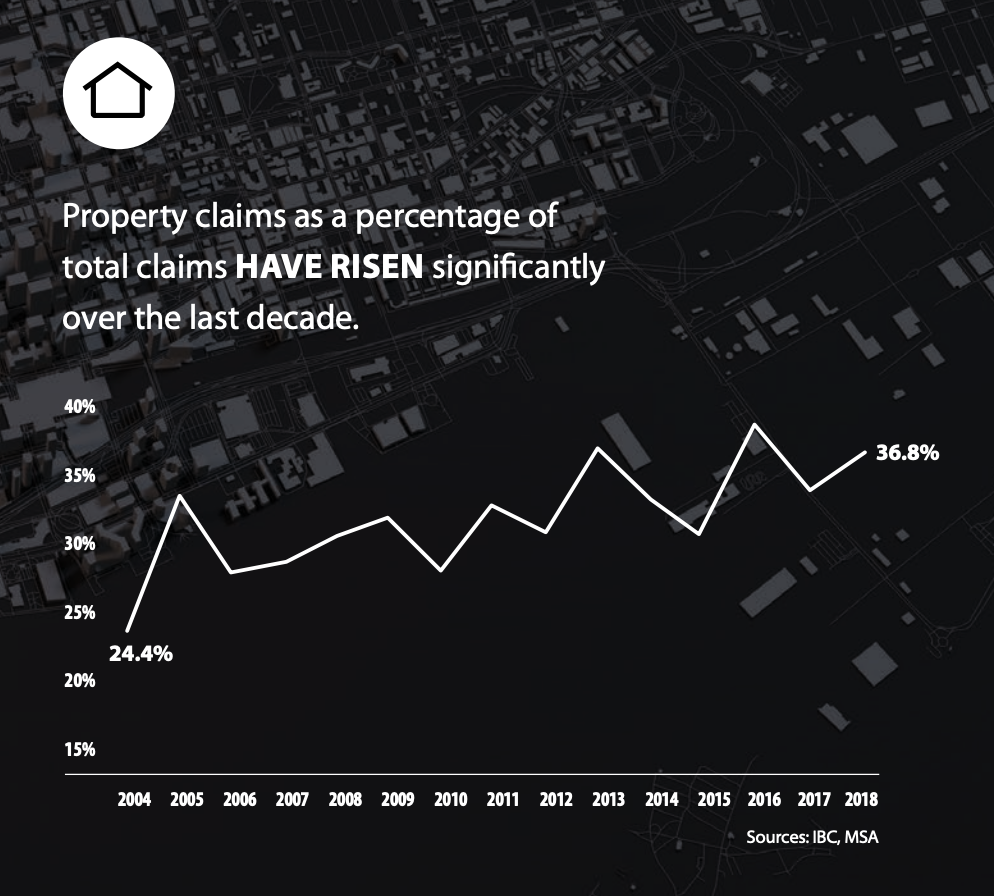

1. Rising Property Claims

Property claims are on the rise. We’ve written about why home insurance claims are soaring on our blog previously. More extreme weather events across the country and larger, more expensive homes are just two factors that contribute to the growth in home insurance claims. This graph from IBC illustrates well the dramatic increase in home insurance and property claims over the course of the last decade.

Image source: 2019 Facts

of the Property and Casualty Insurance

Industry in Canada, IBC

2. Escalating Costs From Natural Disasters

The 2010s was the decade where natural disasters became a real force to be reckoned with. Between 1984 and 2009, the average yearly insured losses from severe weather events were $400 million. Since 2009, insured losses from floods, ice storms, hurricanes, and other extreme weather have averaged $1.4 billion per year (IBC). Some milestones of Canadian catastrophic losses in the 2010s include the Fort McMurray wildfires in 2016 ($3.75 B in insured losses), the Southern Alberta flood in 2014 ($1.6 B in insured losses), and the Slave Lake wildfire ($0.5 B in insured losses).

Not only did the past decade feature some record-breaking disasters, but it also saw a rise in more frequent smaller disasters from coast to coast. The combined effect of the rise in damage to homes and property is putting a strain on the home insurance industry, insurance adjusters, and homeowners alike. In 2018, 56% of insured losses were from wind, tornado, and hurricanes, while the 2009-2017 average for these types of extreme weather events averaged 20% (IBC).

The financial stress of this increasingly wild weather in Canada led insurance industry leaders to sound the alarm to political leaders at all levels of government towards the end of the decade.

3. Technological Tools

Technology has been changing at a rapid pace in the past decade. Drones and Smart Home Solutions are a few pieces of technology that started to affect the home insurance industry.

As an example, drones have emerged as a quick and safe way to estimate structural damage to a home and determine the appropriate claim. According to PropertyCasualty360, drones have helped cut the claims adjustment period from 11 days to 5-6 days in the last decade.

Home automation systems started to emerge in the 2010s. Using a wi-fi connection to monitor and control appliances, lighting, climate, and other home technology, this technology lets the homeowner detect issues early and respond promptly. Although only 16% of Canadians own a SMART home device, the potential for uptake and application of these devices is tremendous. In the future, home automation systems might be able to prevent damage to a home completely!

4. Digital Disruption

In line with the changes in technology, the digitalization of the home insurance industry also had a massive impact over the past 10 years. For some, this rapid change might be overwhelming. In fact, 74% of insurance executives say that technology is changing faster than they can adapt (IIC).

However, consumers are increasingly starting to expect digital functionality and services. Whereas the norm was paper everything, now insurance companies are increasingly embracing technology and digital solutions to provide fast, simple, transparent digital service offerings. Is there still work to do? Yes, but the trend of digitalization will continue and likely accelerate in the 2020s.

5. New Customer Expectations

You may have noticed that we’ve talked a lot about millennials in the past decade. For better or worse, the combination of technological advances and the increasing influence of a generation of “digital natives”, people who have grown up with computers and other digital technology has had a profound effect on many industries, including the home insurance industry.

Insurance customers are increasingly looking for customer service across a range of digital channels. They expect faster and customized service and communication from their insurance provider and adjuster, and insurance companies have been spending the better part of the last decade trying to adjust to and catch up with the changing demand. From submitting claims through an app to connecting with customers via their favourite social media platform, the digital possibilities for exciting and keeping customers happy seemed endless in the last decade.

It’s worth noting that the home insurance companies that fail to keep up with digitalization will have trouble retaining customers and keeping them happy. According to a study by J.D. Power, the home insurance companies that meet their customers’ digital expectations are the companies that score highest in customer satisfaction. Despite the stress and challenges from constantly adapting to new technology and customer expectations, it’s imperative for success!

Getting Ready for a New Decade

The future can sometimes feel scary. The 2010s brought about lots of new challenges and opportunities.

Moving into a new decade, lots of insurance companies and adjusters are struggling to manage an increasing workload, financial strain, and an intensifying of customer service demands.

One way to offset these pressures is to consider professional management of ALE (additional living expenses) requirements. Accomsure provides full, expert management of policyholder ALE requirements from start to finish. We have a proven track record for quickly and cost-effectively handling the rehousing of displaced policyholders. The result is lower overall claim costs and satisfied policyholders – while reducing the workload for both parties.

The future is here. How are you getting ready for the challenges of a new decade?