2023 is a new year that will bring new advancements (and setbacks) to the Canadian home insurance industry.

With the acceleration of digital transformation, increased claim costs due to climate change, and inflation, it’s never been more important to know about the latest home insurance trends so you can better support your policyholders.

To help you stay ahead this year, we’ve compiled four must-know 2023 home insurance trends that every adjuster should know.

1. Sensorization

Experts predict that in 2023, 15% of all households will have installed at least one type of smart system.

From smart speakers and sleep assistants to thermostats and home security, smart home devices are taking over policyholder homes and becoming an excellent risk management tool. These smart devices can help policyholders lock doors without the key, notify the homeowner of security issues and even trigger alarms when they detect leaky pipes.

As more and more households adopt these devices, more policyholders will be able to detect potential issues or hazards in their homes before they cause any significant damage.

Here are a variety of smart home devices on the market today:

- Security systems: protect homes from theft or vandalism

- Smart deadbolts and garage door openers: allow homeowners to lock or unlock doors to prevent home invasions

- Smart water leak detectors: notify the homeowner’s phone when excess levels of moisture are detected

- Smart smoke and carbon monoxide detectors: provide notifications when smoke or excessive carbon monoxide is detected

With more policyholders adopting these smart home devices into their everyday life, adjusters will likely see a reduced amount of preventable property insurance claims in 2023 and the years to come.

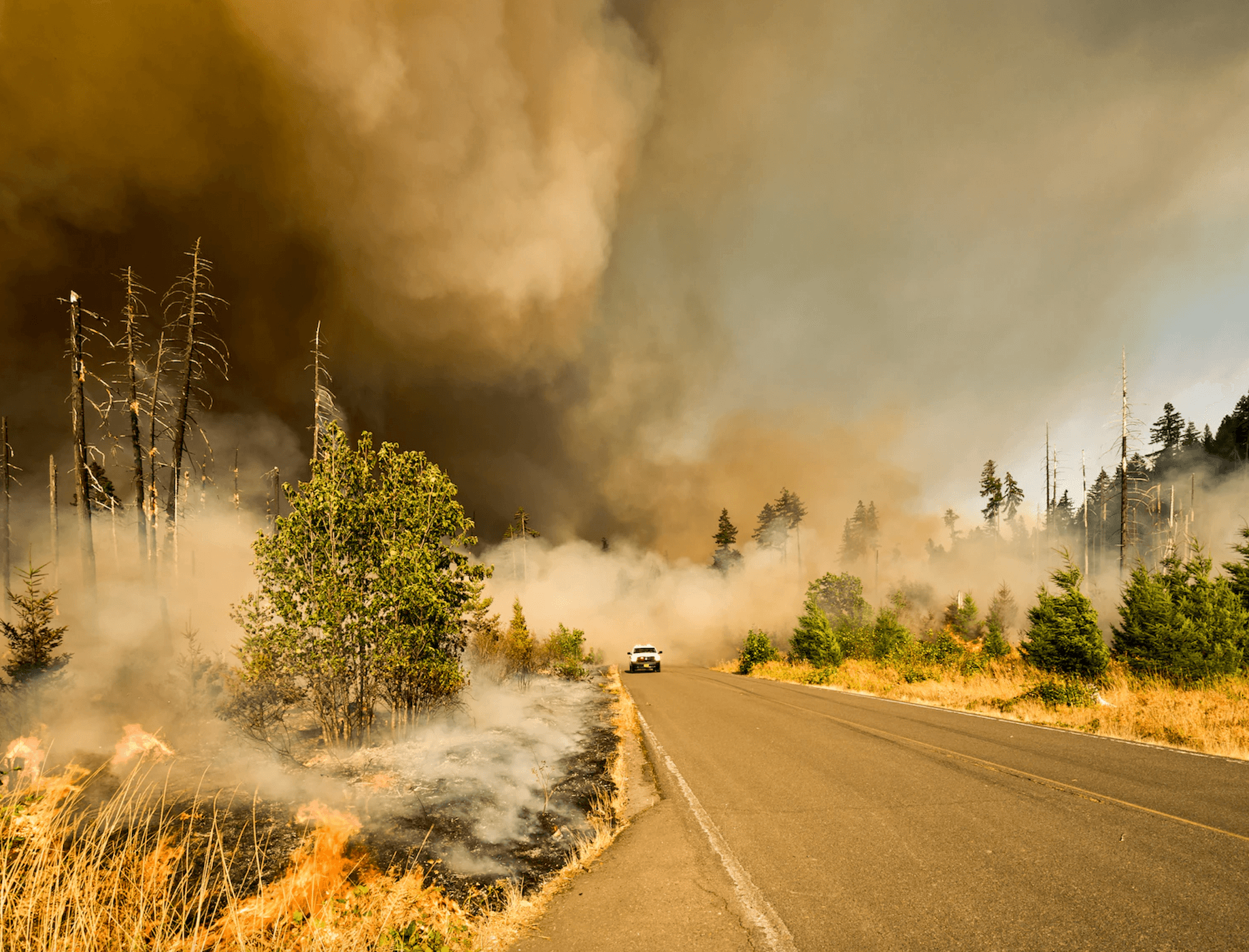

2. Increase in Natural Disasters

Disasters across the globe are increasing at an alarming rate. For example, in 2020, catastrophic disasters cost $210 billion worldwide. In 2022, these events cost a whopping $268 billion.

Although the 2023 Canadian total insured losses amount has yet to be released, we can only project that it will be higher than last year’s, which was $2.1 billion.

The increase in total insured losses is due to various factors, however; most of these factors point to climate change. Over the last few years, Canadians have seen the effects of climate change through the following natural disasters among many others:

- 2021 B.C floods

- 2021 Barrie tornado

- 2021 Southern Ontario storm

- 2020 Calgary hailstorm

Due to the increase in unexpected disasters, adjusters and policyholders will continue to feel the storm with heavier workloads and higher home insurance premiums.

3. Increased Costs Across the Board

According to Trading Economics, the Canadian Consumer Price Index (CPI) reached an all-time high of 153.80 points (6.9%) at the end of October 2022.

Unfortunately, this inflation is affecting not only the grocery shopping and daily purchases but also home insurance.

When a policyholder’s home faces damage, the cost of repairing, restoring, and rebuilding the home is at an all-time high. Not to mention the labour shortages, costly building materials, and supply chain issues that have been hurting Canada’s construction industry for the past couple of years. Coupled with the increase in natural disasters insurance companies are left with no option but to boost prices.

So, in 2023, adjusters should prepare for more stressed and unhappy policyholders.

In this day and age, policyholders will compare rates and switch insurance carriers in a heartbeat if they feel the cost of home insurance is increasing. To reduce the chances of your policyholders switching providers, adjusters must learn how to increase policyholder retention.

4. Increased Adjuster Workloads

Have you ever struggled to support your displaced policyholder with their immediate needs due to your hefty workload? You’re not alone.

With rising inflation, evolving risks, technology transformation, and more, many advancements and challenges directly affect and disturb the workloads of adjusters in the insurance market.

As your workload increases, you may notice your productivity reduce, and stress levels increase. When this occurs, it’s crucial to have ALE management solutions that you can lean on in times of hardship.

ALE management companies, like Accomsure, will work with your policyholder to find temporary housing that meets their specific needs. This support gives you a chance to focus all of your attention on your policyholders claim, while we handle the rest.

Stay Ahead in the Insurance Industry by Adapting to Emerging Trends

With new challenges, increased insured losses, rate increases, and the ever-changing digital transformation, many insurers and adjusters have a lot of work to do to stay ahead in the industry this year.

If you start to feel overwhelmed, let Accomsure take some of your work and mental load off your plate by submitting a claim.