Est. Read Time: 3 Minutes

As an adjuster, you play a primary role in helping displaced policyholders navigate the aftermath of property damage.

Policyholders often become displaced due to unpredictable natural disasters or unexpected damages like electrical fires or frozen pipes that burst. However, some policyholders are constantly at greater risk of property damage than others.

In this article, we’re diving into four common types of policyholders who are at a greater risk of property damage. By understanding the risks many policyholders face, adjusters can better support those displaced due to such calamities.

1. Living in an Older Home

Did you know that newly constructed homes get an average 36% insurance discount compared to older homes?

This discount is due to the fact that aging homes are at greater risk of leaking roofs and pipes, failing hot water tanks and furnaces, frayed electrical wiring, and other potential hazards that cause property damage.

Residing in an aging home can put policyholders at a greater risk of property damage.

For example, according to CTV News, several policyholders became displaced after the roof of their apartment building began to leak, destroying 19 out of 25 rental units in a privately owned building in Ontario. Unfortunately, the culprit of this displacement was an old roof that wasn’t properly maintained or repaired.

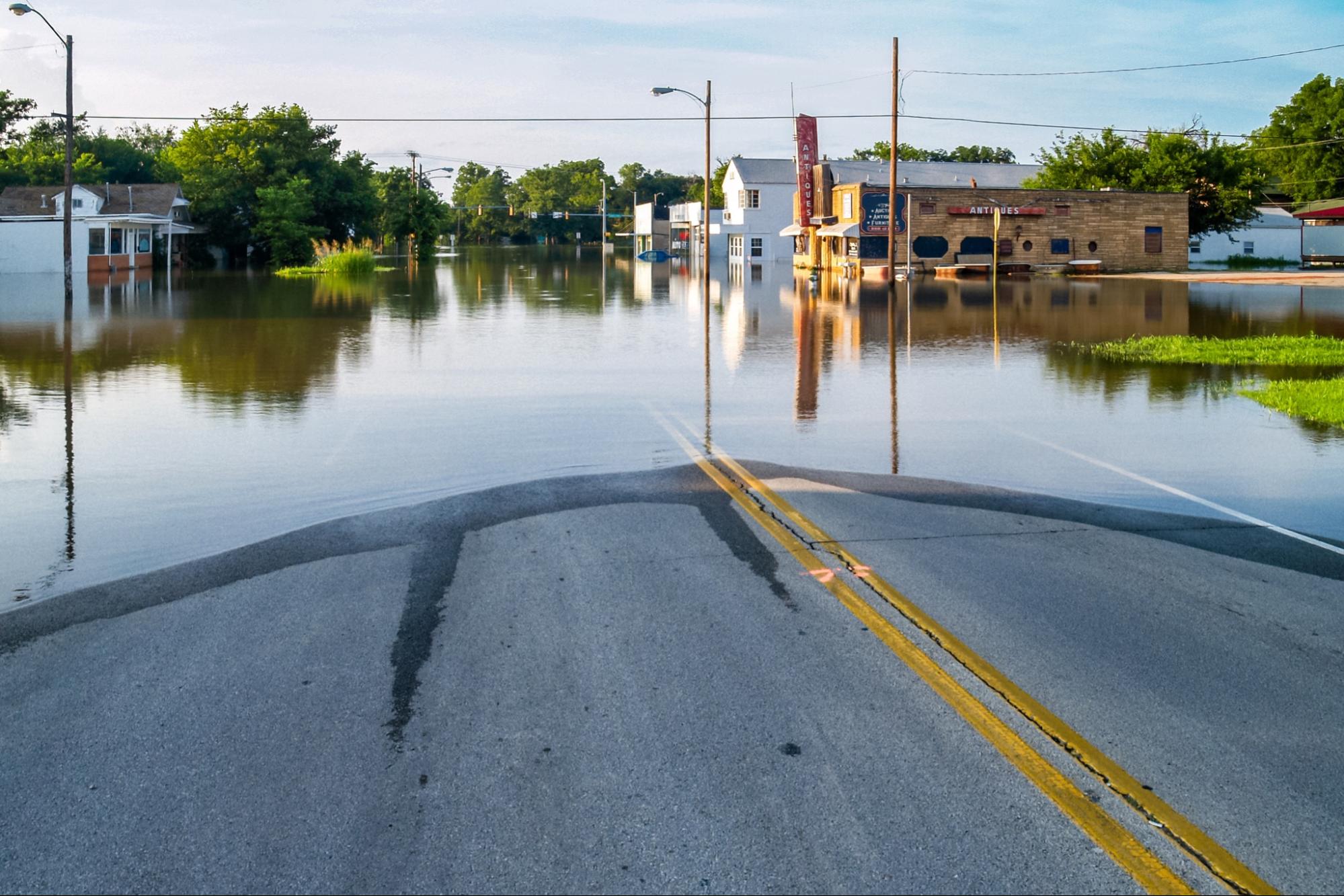

2. Living in a Flood Zone

According to research conducted by a Western University flood-control expert, about 4 million Canadians live in flood-zone areas.

If your policyholder resides in a flood zone, their chances of experiencing water-related property damage significantly increase. With flooding being Canada’s most common natural disaster, policyholders who live in flood zones must understand their likelihood of becoming displaced.

Here are some facts about how floods affect Canadians:

- 2 in 10 Canadian homes are at risk of flooding (and more policyholders aren’t aware of their risk). (Government of Canada)

- 40% of all home insurance claims are due to water damage. (Canadian Underwriter)

- 29% of Canadians claim to have an emergency plan for floods or other natural disasters. (CTV News)

3. Living With Poor Security

Some policyholders have installed smart features, such as security systems and doorbell cameras, but those without put themselves at greater risk.

According to Global News, a Fredericton-area family was temporarily displaced due to vandalism and a break-in that resulted in their electronics and other belongings being stolen, holes in walls, food from the fridge thrown around their home, and more.

This family was new to the area and was renting a home in what they thought was a safe and secure community. The Red Cross provided them with a three-night stay in a nearby hotel, but they had to reach out to the Salvation Army for support until their home was liveable again.

4. Living in a Wildfire-Prone Area

According to Canadian Science Publishing, approximately 12.3% of Canadians currently reside in the wildland-urban interface (WUI), a zone between wilderness and land developed by human activity.

With an average of 8,000 wildfires occurring annually, those living in the WUI are at significant risk of being displaced due to a catastrophic wildfire.

What Adjusters Should Do if Policyholders Become Displaced Due to Property Damage

From living in an aging or less secure home to residing in a community prone to natural disasters like floods or wildfires, a variety of policyholders are more likely to experience some form of property damage due to the condition and location of their homes.

Should your policyholder become displaced due to property damage, partner with a reliable ALE management company like Accomsure.

Accomsure can assist your displaced policyholders with their immediate needs, like finding temporary housing, so you can focus on their claim. We work hard to find accommodations that meet your policyholder’s needs and fit within their claim limits.

If your policyholder becomes displaced, submit a claim with Accomsure.