Over the past decade, hundreds of thousands of Canadian policyholders have faced displacement due to natural disasters, cooking fires, burst pipes, and more.

When policyholders become displaced, they rely on adjusters to provide efficient and appropriate services as well as compassionate support.

However, providing the very best service all of the time can be quite challenging when working in high-stress environments and constantly dealing with a hefty workload.

That’s where ALE management services stand out as a transformative investment.

The following are seven ALE management benefits that expand on why partnering with an ALE management company is a strategic move for optimizing the claims management process and increasing satisfaction in displaced policyholders.

1. Efficient Claims Handling

Displacement claims can take considerable time due to the intricacies of assessing and addressing displaced policyholders’ diverse needs and unique claims situations.

ALE services can help streamline the claims process in two primary ways:

- ALE management companies will communicate with the displaced policyholder, who likely has never been in this situation and has many questions and concerns about the process, allowing adjusters to focus on the claim without wasting valuable time going back and forth with the policyholder.

- When policyholders require additional living expenses from their insurance policy, they must understand their budget and effectively plan its utilization. This often involves navigating complex steps, such as assessing how much they can spend on their temporary accommodations, making it a task that they hope adjusters can handle on their behalf. ALE management companies can support policyholders with the allocation of their ALE budget and help them use this money appropriately for their immediate needs, like for expenses associated with getting temporary accommodations.

2. Accurate & Compliant Assessment

When claiming additional living expenses, displaced policyholders must keep all receipts, invoices, or other documentation to prove where they spent their money. They then must provide this information to their adjuster, who has to validate that their expenses fit within their policy limits.

With external support, ALE management companies can review and verify the incurred expenses for temporary housing against the policy coverage, ensuring that the costs claimed align with the policy terms.

Acting as a middleman, ALE management companies can work directly with displaced policyholders and take the workload off the adjuster while ensuring accurate and compliant assessments.

3. Cost Savings

One of the most significant benefits of working with an ALE management company is the significant claim cost savings they can provide.

Here’s how ALE management companies can help save money:

- They can typically negotiate the cost of temporary accommodations by leveraging their extensive network and expertise.

- They’re experts at managing the logistics of the displaced policyholder’s immediate needs, including finding temporary housing that fits within the policy limits.

For example, Accomsure helped an insurance company save $120,000 on claim costs after a low-income multi-unit building caught fire. Here’s how:

- We found temporary accommodations for all displaced policyholders and negotiated a discount of $177 per night per room.

- The temporary accommodations included kitchens within their suites, so per diems did not need to be dispersed, allowing insurance funds to be extended by an additional 2.5-3 months.

- The property utilized for this placement did not offer third-party billing, except through Accomsure.

4. Improved Customer Satisfaction

When displacement occurs, policyholders often grapple with a mix of emotions, typically experiencing frustration and discontentment when filing claims due to their sudden displacement.

Displacement raises many questions for policyholders, like “Where will I live?”, “how long will it take for my home to be restored?” “how can we speed up this process?” etc.

During this time, policyholders expect adjusters to provide timely and appropriate support. However, in cases of large-scale losses such as catastrophic events, it can be challenging for adjusters to respond as quickly as they would like due to claim loads.

That’s where ALE management services come into play.

ALE management services are a crucial bridge to ease this initial discontentment by alleviating immediate challenges, like finding temporary accommodations that meet unique needs and answering any questions that the policyholder may have. This support can enhance customer satisfaction and loyalty.

5. Reduced Adjuster Workload & Stress

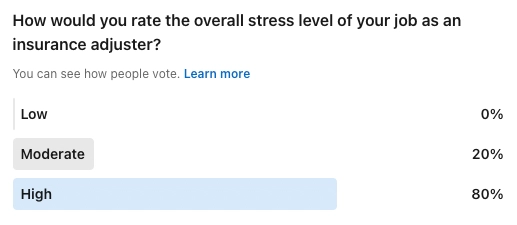

Recently, we conducted a poll on LinkedIn and asked adjusters about their stress levels. 20% of respondents reported “Moderate” levels of stress, with a whopping 80% reporting “High”.

By outsourcing ALE management, adjusters can hand over a lot of their workload so they can focus on other critical aspects of claims handling. Getting additional help will relieve adjusters as they will have more time to focus on claim management, ultimately reducing stress.

6. Fraud Detection

According to RateHub, 15% of insurance premiums go to covering past fraudulent insurance claims.

Home insurance fraud most notably occurs when policyholders exaggerate their claims, restoration costs, or additional living expenses.

ALE management companies can review the legitimacy of additional living expenses for temporary housing claimed by policyholders. This thorough review will help identify inconsistencies or irregularities that might indicate fraudulent activities.

Additionally, at times, landlords may increase rent when they discover it’s an insurance claim. ALE management companies, like Accomsure, stop rent increases from happening.

Overall, ALE management companies can closely collaborate with adjusters and directly share any insights or data that may indicate potential fraud, saving insurance companies money and resources.

7. Enhanced Reputation

Policyholders are constantly looking for an insurance company to provide them with the most coverage for the lowest cost. Once a policy expires, policyholders typically shop around and get quotes from various insurance companies.

However, there is a way to retain policyholders: provide exceptional service.

When you work with an ALE management company, they will work hard to provide effective customer service and keep your policyholders happy, which can retain your policyholders and enhance your company’s reputation.

Choose Accomsure as Your Go-to ALE Management Company

Accomsure’s expertise in ALE management and supporting displaced policyholders helps insurance companies streamline operations, enhance overall claims management efficiency, and better support customers.

If you want to experience all of the benefits of working with an ALE management company, submit a claim or contact Accomsure today.

We’re looking forward to supporting you and your displaced policyholders.