The Situation

When a family experienced a devastating fire on their acreage in southern Alberta, Accomsure quickly helped the policyholders find accommodation that met all of their needs while their home was rebuilt.

The Challenge

The policyholders were a family of 2 adults, 3 children, and 3 dogs, who lived on an acreage in a remote area of southern Alberta. It was important for the family to be rehoused close to their primary residence, so they could keep an eye on their livestock and remain close to the children’s bus route to school.

What Accomsure Did

Within a couple of hours, Accomsure had placed the family in a hotel in the nearest town. After a good, immediate housing solution was in place, Accomsure set out to find long-term accommodation for the family close to their original home.

Within only a few days, Accomsure located a suitable 4-bedroom home within 5 km of their primary residence, complete with a fenced yard that could accommodate the family’s 3 dogs. Although the house was unfurnished, Accomsure arranged for rental furniture to be delivered within 2 business days.

The whole family was settled into their temporary home that maintained their standard of living in less than a week of the devastating fire.

Benefits for the Insurance Adjuster

Finding the right accommodation at a cost that aligns with the home insurance policy can be a stressful and time-consuming task, following a disaster like a fire in the home. Without Accomsure’s services, the onus is usually on the policyholder to research and find a temporary home. Since the policyholder might not have knowledge of the market and experience with insurance claims, the additional living expenses (ALE) costs can quickly escalate beyond the additional living expenses coverage limits. Accomsure can help the adjuster by keeping policyholders satisfied with the level of service provided, managing policyholder expectations, and limiting the risk of escalating claim costs.

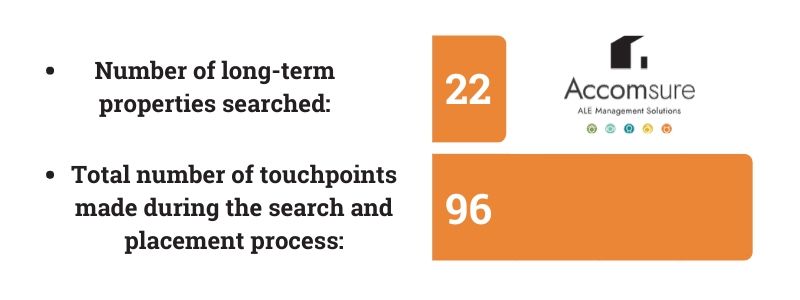

To put the scope of work that goes into a relocation into context, here is some data on the process.

In this case, Accomsure managed the relocation, so the policyholders could focus on their immediate needs and progressing the claim. The professional management of ALE requirements came with a number of benefits for the insurance adjuster and the insurance company.

By leveraging Accomsure’s preferred supplier network, they were able to reduce the initial hotel rate by 25% and reduced the claim’s overall temporary accommodation cost by 30%. Accomsure also helped ensure that the costs of temporary housing were kept within the ALE coverage policy limits.

Accomsure was also able to identify additional cost reductions on extra expenses by ensuring the family was relocated to a hotel with a kitchen, so the family didn’t need to eat out and accumulate expensive bills for restaurant meals. The hotel was also in close proximity to their acreage, which meant the policyholders experienced less disruption to their business and a lower mileage cost for travelling back and forth to tend to their livestock.

Beyond the significant savings to the claim, the adjuster was also assured that the ALE requirements were managed in a way that both met policyholder expectations and were within the home insurance policy limits. During the property search and settlement process, Accomsure was able to take on a large portion of work that would otherwise have fallen on the policyholders, so the family and the adjuster could focus on advancing the claim.

Benefits for the Policyholder

For the policyholders, losing their home to a fire and being forced to navigate a completely new situation is understandably challenging and stressful.

While it was the first time the policyholder had to go through this type of relocation and insurance process, the Accomsure team leveraged their years of experience and network of contacts to quickly find the perfect accommodation that worked for the whole family. By conducting the property search on behalf of the family, Accomsure provided peace of mind for the policyholder, so they had time and energy to start rebuilding their lives again.

The family was able to stay close to their primary residence, so they could continue to manage their livestock and keep their children on their normal bus route to school. With the family’s priorities in mind, Accomsure was able to find a temporary housing solution that caused as little disruption as possible to their everyday lives and maintained their standard of living.

In the end, the family was very grateful for having Accomsure by their side during one of the most stressful times in their lives. Through fast, professional management of the additional living expenses (ALE) part of the claim, Accomsure was able to provide the insurance adjuster with significant value in terms of keeping the ALE coverage costs associated with the claim low and saving time for both the adjuster and policyholder. Additionally, impressing the policyholder with a high level of service reflected well on the insurance adjuster and the insurance company and increased overall customer satisfaction.

“Dealing with this devastating fire was one of the most stressful things we have ever experienced. My wife and I didn’t know where to start, our minds were a blur. That phonecall from Accomsure truly gave us peace of mind. They got us into a hotel and went to work finding us the right home while ours was being rebuilt. I’m not sure where we would have been without them.” –Policyholder